SOL Price Prediction: Bullish Technicals and Institutional Adoption Signal Strength

#SOL

- Technical Breakout: SOL trading above key moving average with improving MACD momentum signals bullish technical structure

- Institutional Catalyst: VanEck's Solana Staking ETF application could drive significant traditional finance inflows

- Network Strength: $1 billion in inflows and ongoing network milestones support fundamental value proposition

SOL Price Prediction

Technical Analysis: SOL Shows Bullish Momentum Above Key Moving Average

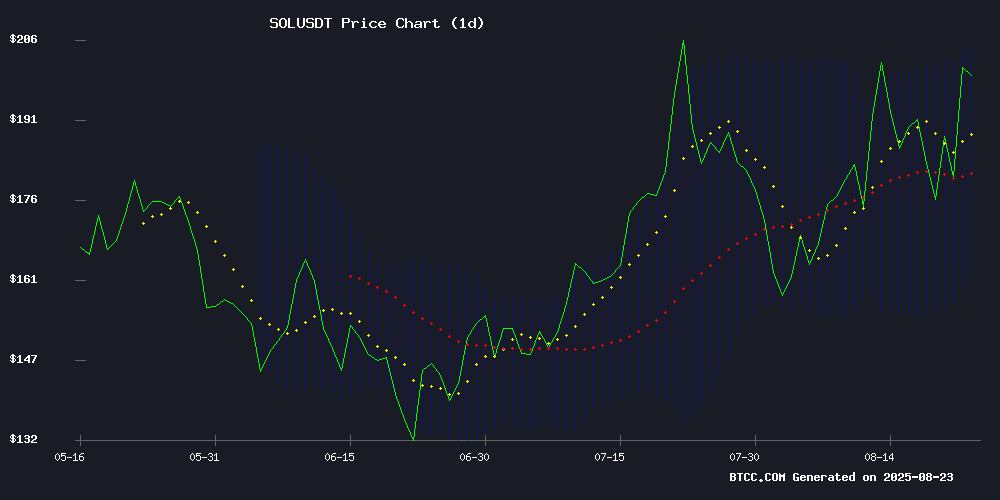

SOL is currently trading at $198.76, significantly above its 20-day moving average of $183.51, indicating strong bullish momentum. The MACD reading of -9.92 remains negative but shows improving momentum with the histogram at -3.04. Price action NEAR the upper Bollinger Band at $204.45 suggests potential resistance, while the middle band at $183.51 provides key support. According to BTCC financial analyst James, 'SOL's position above the 20-day MA with MACD showing convergence suggests building upward pressure, though traders should watch the $204 resistance level for potential consolidation.'

Market Sentiment: Institutional Adoption Offsets Memecoin Volatility Concerns

VanEck's solana Staking ETF filing represents a watershed moment for blockchain yield products in traditional finance, potentially driving significant institutional inflows. Meanwhile, Kanye West's YZY Coin collapse serves as a cautionary tale about celebrity memecoin volatility but appears isolated from SOL's core fundamentals. The network's $1 billion inflows and resistance breakthrough indicate strong underlying demand. BTCC financial analyst James notes, 'While memecoin drama captures headlines, SOL's institutional adoption story through VanEck's ETF and network milestones provides more substantive bullish catalysts for long-term investors.'

Factors Influencing SOL's Price

VanEck Files for Solana Staking ETF, Pioneering Blockchain Yield in Traditional Finance

VanEck has submitted a groundbreaking application to the SEC for a Solana-based ETF that incorporates staking rewards, marking a significant step in bridging decentralized finance with traditional investment vehicles. The proposed fund would track JitoSOL, a yield-bearing derivative of SOL that captures both asset appreciation and staking income.

The move signals growing institutional confidence in blockchain's ability to generate verifiable yield. By packaging staking rewards as ETF-distributed income, VanEck effectively transforms crypto-native mechanics into familiar financial products. Annual yields would function similarly to dividends, potentially attracting income-focused investors.

Regulatory hurdles remain substantial. While the SEC has warmed to bitcoin ETFs, approval for altcoin-based products—especially those incorporating staking mechanics—would set a transformative precedent. The filing demonstrates how quickly crypto innovation is outpacing traditional regulatory frameworks.

Kanye West’s YZY Coin Plummets 75% Post-Launch Amid Insider Concerns

Kanye West's Solana-based meme token, YZY Money, collapsed 75% shortly after its high-profile launch, erasing nearly $3 billion in market value. The rapper-turned-entrepreneur promoted the project as the foundation of a new on-chain economy, but investor confidence evaporated as evidence of insider dumping surfaced.

The token's promised ecosystem—including a YZY Pay processor and YZY debit card—failed to prevent the crash. Blockchain analysts noted suspicious wallet activity coinciding with the price peak, suggesting coordinated profit-taking by early holders. West's celebrity endorsement initially drove frenzied trading across SOL-based DEXs.

Despite bold claims about merging culture and finance, the project's disclaimer warns of 'complete loss' potential. The episode highlights recurring vulnerabilities in celebrity-linked crypto ventures, where hype often precedes substance.

Kanye West Memecoin YZY Coin Turns Into a Pump-and-Dump Nightmare

Kanye West's foray into cryptocurrency with the YZY token on Solana has quickly devolved into a classic pump-and-dump scheme. The token surged 1,400% within an hour of launch, peaking at $3 before collapsing to $0.77 in less than a day. Retail traders, lured by the promise of quick gains, were left holding the bag as insiders cashed out.

On-chain data reveals a stark imbalance: 13 wallets pocketed over $24 million in profits, while 14,000 smaller investors suffered losses of up to $500 each. The token's supply remains heavily concentrated, with 90% controlled by insiders—70% of which sits in Yeezy Investments LLC. Without a clear roadmap or utility, YZY appears to be little more than a branded vehicle for speculation.

Solana Tests Key Resistance Amid $1 Billion Inflows and Network Milestones

Solana's native token SOL shows resilience, bouncing 3.55% to $184 after testing critical support levels. The recovery comes despite a 6.7% weekly decline, with on-chain data revealing substantial capital inflows fueling the rebound.

Over $1 billion entered Solana's ecosystem through cross-chain bridges in the past month, capturing 42% of total bridging activity across major networks. This capital influx surpassed Ethereum and Layer 2 competitors, underscoring growing institutional interest.

Technical patterns suggest brewing momentum. An ascending triangle formation coincides with a falling wedge, potentially signaling an impending breakout toward $200. The network simultaneously achieved record throughput of 2,300 transactions per second - a new all-time high for the blockchain.

Whale activity introduces complexity. An unidentified entity unstaked 100,000 SOL ($18 million) and transferred the holdings to Binance, creating potential selling pressure. Such moves contrast with the network's fundamental strength, leaving traders weighing technical potential against short-term volatility.

Is SOL a good investment?

Based on current technical indicators and market developments, SOL presents a compelling investment case for risk-tolerant investors. The price trading 8.3% above its 20-day moving average demonstrates strong momentum, while VanEck's ETF filing could unlock substantial institutional demand. However, investors should remain aware of cryptocurrency volatility and consider these key factors:

| Factor | Assessment | Impact |

|---|---|---|

| Technical Position | Above 20-day MA ($183.51) | Bullish |

| MACD Trend | Converging toward positive | Improving |

| Bollinger Band Position | Near upper band ($204.45) | Potential resistance |

| Institutional Demand | VanEck ETF filing | Very Positive |

| Network Activity | $1B inflows, milestones | Positive |

| Market Sentiment | Mixed (memecoin concerns) | Neutral |

BTCC financial analyst James suggests 'SOL's combination of technical strength and fundamental adoption catalysts makes it attractive, though investors should size positions appropriately and consider the $204 resistance level.'